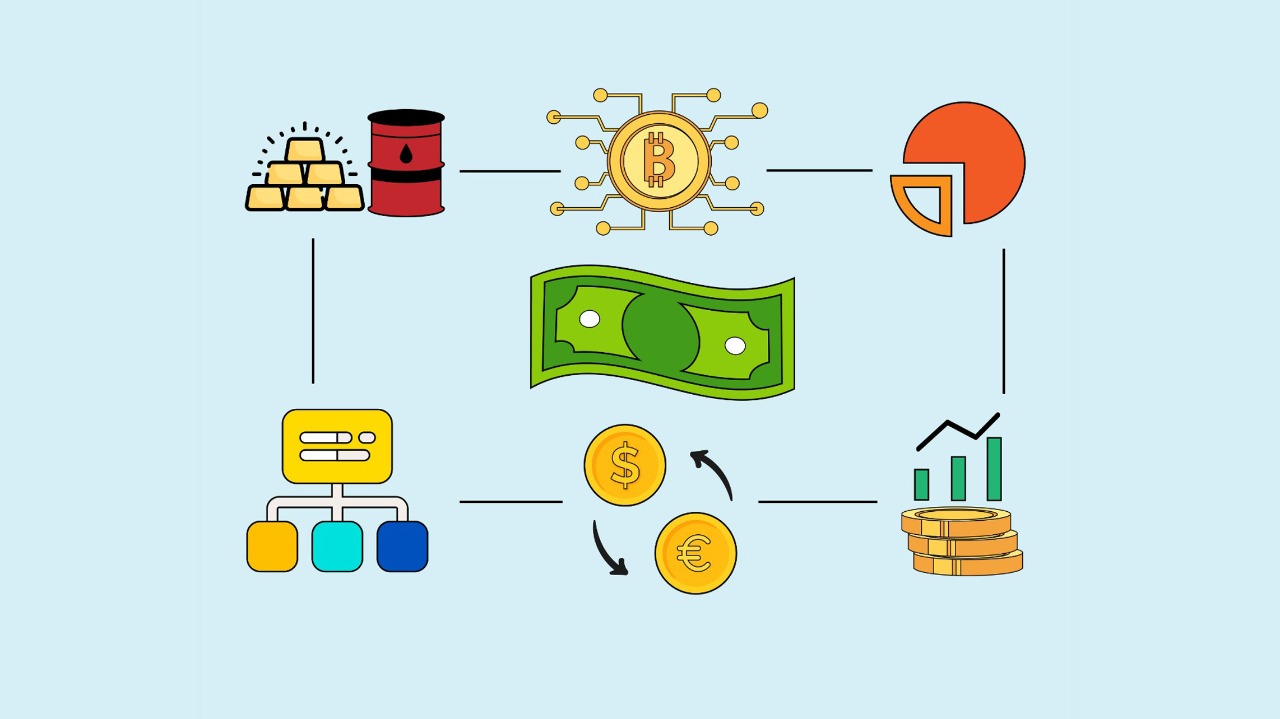

Money is essentially fungible; people are considerably predictable; sentiments are drastically vulnerable; businesses are consistently dynamic; markets are seismically vacillating and times are only superficially nice. Living and breathing in this day and age demands a certain extent of judiciousness in one’s investment choices, for which one must be first acquainted with the possible choices.

- The Capital Market:

It is loosely classified into the equity/stock market and the debt market. In its very essence, investing in shares is about accumulating and multiplying wealth as businesses go through the life cycle and shares engender value creation, along with dividends. However, trading for speculation purposes is exploiting market fluctuations through capital appreciation.

Bonds and debentures, the debt market instruments which are relatively stable compared to stock, are fixed income securities. Investors trade them according to the prevailing interest rates. The coupon rate of bonds is fixed, while the interest rates fluctuate. Should the interest rates fall below the coupon rate, bonds become attractive and are preferred overbank deposits.

The opposite is true when interest rates rise above the coupon rate. Ergo, the principle that bond prices increase as interest rates fall, and vice versa, is famously stated.

- The Money Market:

Money market instruments are a popular choice among risk-averse investors since they are secure, more liquid, less volatile and give fixed income. The stock markets are generally in a continuous flux, and when investors are not sure of where to park their money, especially in times of crisis and turmoil, money market instruments can be a safe place to do so.

Treasury bills, Certificate of Deposits, Commercial Papers, Repurchase Agreement (Repo) and Banker’s Acceptance are some money market instruments of investment. Usually, the Central Bank of the country regulates the transactions of money market instruments. Since the minimum value for money market transactions is higher, the extent of this market is deep and wide and even a small tweak can cause a wave of consequences.

An example of this can be cited as what happened in Repurchase Agreements in 2007-08. A run on the Repo market, wherein funding for investment banks was either unavailable or at a very high-interest rate, was a key aspect of the subprime mortgage crisis which eventually led to the Global Financial Crisis in 2008.

- The Derivatives Market:

It involves transactions of derivatives over underlying assets like stocks, bonds, currency, commodities, interest rates and market indexes. It is essentially betting over something that is already bet upon. Since these instruments are derived from and based on other financial markets’ instruments, they are called Derivatives.

Derivatives mainly serve the purpose of hedging a position or speculating over the directional movement of the underlying asset or giving leverage to holdings. Futures, options, swaps, forwards and credit default swaps are some popular derivatives frequently traded.

They are traded either on exchanges or over-the-counter which carries counterparty risk of default. It must be noted that the derivative has no intrinsic value of its own. Its value is derived from the underlying asset and hence subject to all the fluctuations, risk and sentiment of that asset, and more.

- The Commodity Market:

It contains the trading of commodities either physically or through derivatives. Hard commodities include gold, rubber, oil, silver and other metals and soft commodities include wheat, corn, rice, sugar, soya beans, coffee, oats, cattle, cotton, meat, fruits and milk.

Forwards, futures, swaps, exchange-traded funds, exchange-traded notes and contracts for difference are some derivative instruments for trading commodities derivatives.

- The Foreign Exchange Market:

This market is the largest and the most liquid of all the financial markets. The geographical dispersion, round-the-clock working from Sydney to New York, huge trading volume, dynamic determinants of the exchange rate, low margin of relative profit and the use of leverage makes this market stand out from the rest.

Speculation and risk aversion are two motives behind currency trade and currency derivatives, though this is regulated by the monetary policy. The practice of carrying the trade of currency can produce high profitability for the investor due to the difference between the interest rates of two currencies, especially if high leverage is used.

However, like all levered investments, it is a double-edged sword that cuts on both sides and can create huge losses in case of price fluctuations. The American dollar, the Japanese yen, the Euro and the Swiss Franc are commonly regarded as safe-haven currencies, however, they too topple in the face of severity.

- The Cryptocurrency Market:

This market recently had an exponential movement with perhaps an esoteric hint of mystery as well as spanning emergence. Cryptocurrency is perhaps the hottest investing avenue prevailing now. Bitcoin, Ethereum, Litecoin and Ripple are the four biggest and most popular cryptocurrencies in the market today.

Buy and hold (Bitcoin, Litecoin, Ethereum, Ripple), buy and hold for dividends (Neo, KuCoin, Cryptobridge, Neblio, Komodo), staking (Neblio, Komodo, PIVX, Decred, Navcoin) mining, day trading, currency, and exchange arbitrage, hosting master node are some of the strategies to earn via cryptocurrency.

Since the cryptocurrency market is completely decentralized, the volatility of the crypto market fluctuates at a much higher and more dramatic rate. Schemes, bubbles, traps, sensational frenzies, pumps and dumps affect the value of cryptocurrency hour by hour.

No centralized body, no regulation and a lack of information available because of the novelty of this topic keep it relatively obscure from the view of common potential investors.

Apart from these wide markets, there are other equally popular channels of investments like real estate, mutual funds and life insurance. It is essential to first identify your goals and preferred nature of the investment, then analyze every avenue in that context and only then proceed to actually invest.

A combination of multiple avenues and thereby diversification of investment portfolio can strengthen the chances of returns, hedge, longevity and profitability.