Finance is both a science and art. It is the study of managing, investing and creating money. Finance can be categorized into three categories:

- Personal Finance

- Corporate Finance

- Public Finance

So what constitutes finance? Here are some examples to help you understand better:

- Investing your personal money in stocks, taking a loan from a bank, buying and trading bonds.

- Filing tax returns and managing your finances with a spreadsheet.

- Saving money in a savings account and investing in mutual funds.

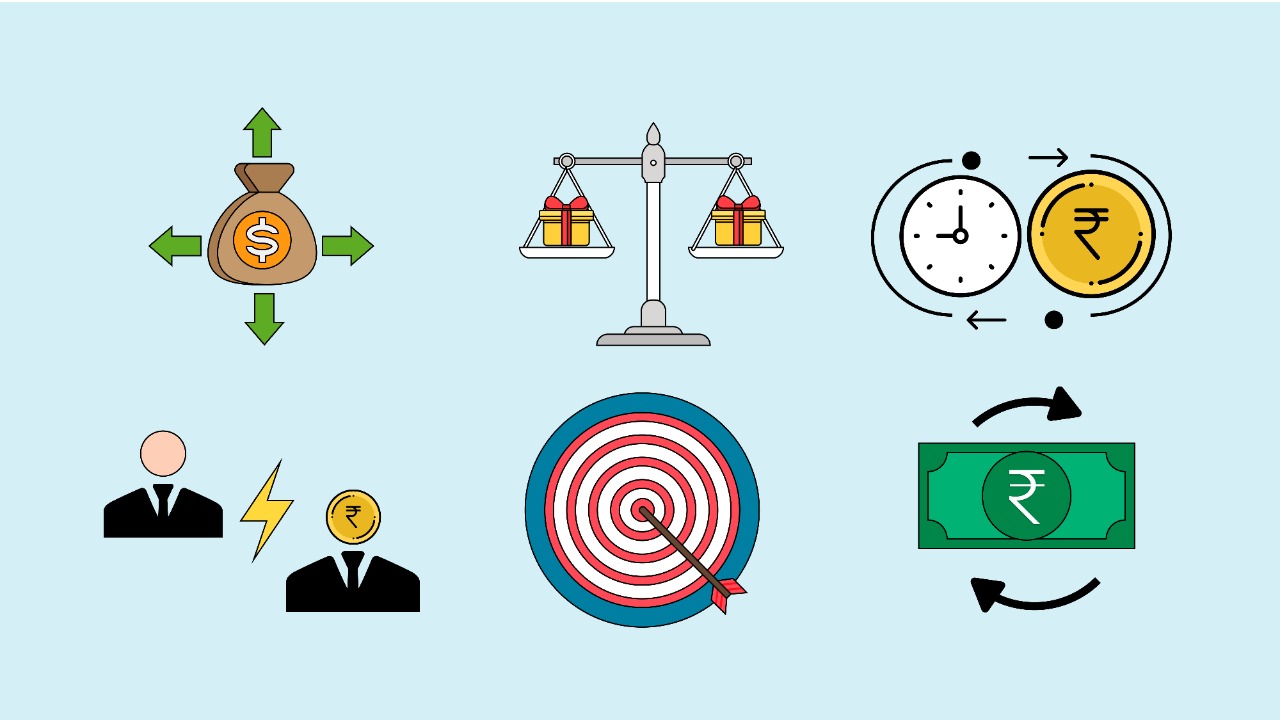

There are 6 core principles that need to be understood in order to have proper finance fundamentals and ensure maximum benefit. The golden rules act as a guideline for investment and financing decisions. Here are the foundational rules that hold true all the time:

- Money has a time value.

- Risk is directly proportional to reward.

- Diversification can reduce overall risk.

- Markets are efficient in pricing securities.

- Manager Goals vs Stockholder Goals

- Cash flow principle

Money Has Time Value:

A certain amount of money in the present will not have the same value in the future. For example, ₹100 in 2020 will be of lower value in the year 2030. This principle holds if money can earn interest. It is because of this that it's important to put your money to work because a pile of money that is not invested or not put into an interest-earning account is losing value over time. It is, therefore, important to keep the rate of return greater than the inflation rate to avoid losing money.

Risk Is Directly Proportional To Reward:

For investments, it is important to keep in mind that the greater the return it promises, the higher the risk of losing money. You can use this principle to decide if you should invest in a particular asset or not. If the risk of making a loss is relatively high compared to the reward then it is a bad investment. The safer the investment, the lower the chance that you might lose your money.

Diversification Can Reduce Overall Risk:

The third principle states that diversifying your investments can reduce the overall risk for your portfolio. Simply put, the more unrelated your investments are, the lesser is the overall risk. For example, if you invest ₹1000 in the textile market and if, due for any reason, the textile market crashes, you are exposed to losing all the money in that market. Instead, if you invest ₹500 in textiles and ₹500 in the automobile sector and when the textile market goes down you’ll risk losing only ₹500 instead of the whole ₹1000. The underlying idea is that losses in one market rarely affect other sectors.

Markets Are Efficient In Pricing Securities:

An efficient market is one where the prices of the assets traded in that market fully reflect all available information at any instant in time. The market follows the news on a company, the supply and demand of their product or service as well as other parameters. The market prices “tend” to reflect fully, all the readily available information of the particular security. The reason we say “tend” is because no market is 100% efficient. Note that efficient markets do not mean that the current price of a particular security is either “right” or “wrong.”

Manager Goals vs Stockholder Goals:

There can be a conflict of interest when the manager does something which they think would be the best for the company and that may not align with the interests of the shareholders.

Cash Flow Principle:

Cash flow is the amount of money, monetary assets and likewise equivalents that are being transferred in and out of a business. Positive cash flow shows that a company is adding to its cash reserves. Positive Cash Flow, not profits, pays the bills and represents money that can be spent and reemployed to make more money. Consequently, it is cash flow, not profits that determine the value of a business.

Quite a few concepts in finance originate from economics yet, the most complex situations can be boiled down to its fundamental principles and hence, it is important to never forget these foundational principles. Although there are exceptions to everything, these rules will stay true most of the time. Let these rules guide you and act as a rail as you climb the staircase of finance.