The film and TV industry has set a standard stereotype for all college graduates, or to be honest, for millennials as a whole - young, dumb, and broke. All of the characters in such an age group are shown either enjoying the privilege given to them by their parents or trying very hard to manage their daily bread and butter. And while the reality isn't that far from this, it doesn't have to be exactly what it is so famously portrayed as.

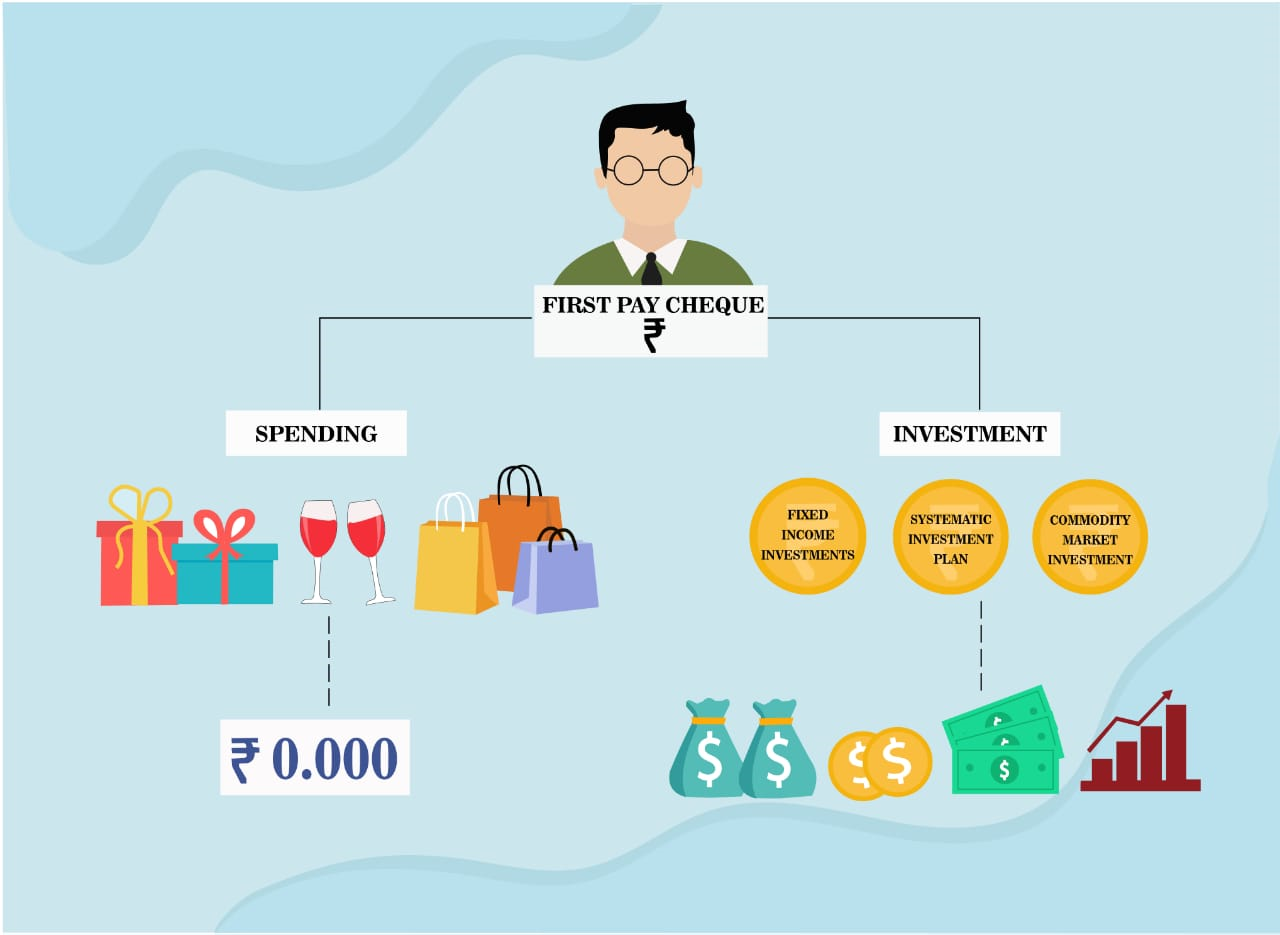

There are a million thoughts that come to your mind when you get your first paycheck. Partying with your friends, getting gifts for your family, taking your partner out for dinner and whatnot. And in the end, there is a small voice, telling you something that you already know - you can either work for the money or start making the money work for you.

The concept of investments is simple - you let your money create more money for your future self. This money may be used for any purpose - further education, starting your own business or maybe just creating an asset like a house or a car. Or maybe, if one is dedicated enough, they can turn their investments into an entire career and a successful one at that.

The traditional mindset tells you to enjoy your first few paychecks and why not? You have a long life left, no responsibilities on your heads and plenty of time to start saving. The flaw in the equation that most people make is:

Income - Expenditure = Savings

This seems like a completely normal statement to put down. However, it needs to be the other way round. Money needs to be saved first. If you want your money to work for you and not the other way round, you have to follow the correct way to manage it, which is:

Income - Savings = Expenditure

The argument usually made here is, "How can one start saving right out of college? Income at this stage is not exactly high". Well, there is no foolproof or ideal savings plan. But here are some ways in which college students can start creating investment portfolios in their limited budgets:

1. Fixed income investments:

These are the safest investments possible. The equation here is simple - you pay x amount for y number of years, which then gives you z returns after y number of years. This can be either a lump sum amount or continual returns.

Government schemes are the most common form of investment in this cadre. Furthermore, life insurance companies have integrated insurance and fixed income investments to come up with ideas like 'retirement planning' and 'smart family financing'.

2. Investing in SIPs:

An SIP or Systematic Investment Plan allows you to invest a fixed amount regularly in a mutual fund scheme, typically an equity mutual fund scheme. These are having comparatively higher risk factors, but also have higher rates of return.

Mutual funds and SIPs are usually associated with 'market risks' and hence, are considered 'complicated'. However, this isn't the case. With every investment, a slight amount of risk is always associated and if investments are made after a proper study of the market, the risk percentage falls even further.

SIPs can be invested in amounts as low as ₹500 per month and with time periods as low as 4-5 years. This makes them an ideal investment for the younger cadre of investors. Investing continually over a time period also decreases your risk since you’re essentially averaging out market volatility.

3. Investing in the Commodity Market:

The commodity market consists of trading commodities, either physically or through derivatives. The most popularly traded commodities are noble metals like gold and silver.

These mainstream commodities, while they carry a slight amount of risk, have given steady returns over the long term. Gold prices, which were swinging around ₹4000 per 10 grams when the millennials of today were born, are at over ₹40,000 per 10 grams.

The USP of purchasing commodities is that they have the option of investing a single lump sum amount and making a higher lump sum amount over time. These might seem expensive, but as compared to other single-investment possibilities, these require relatively smaller investment and also have a relatively lesser percentage of risk.

Keep in mind that investing in commodities can be as risky as investing in equities, but keeping a smallholding of popular commodities like gold allows you to manage your exposure in times of a market crash. You can start commodity trading once you have gained some knowledge and experience of the markets. You can also invest simply in mutual funds or ETFs that have some amount of commodities in their portfolio if you have less capital.

There are many other possible avenues of investment, which can be found in our other blog - Wealthfare Explains: Different Avenues of Investment. Millennials' image regarding fiscal matters might not be completely wrong today, but the other image they have isn't wrong at all: if they are determined enough, they can achieve anything, including a successful investment portfolio.