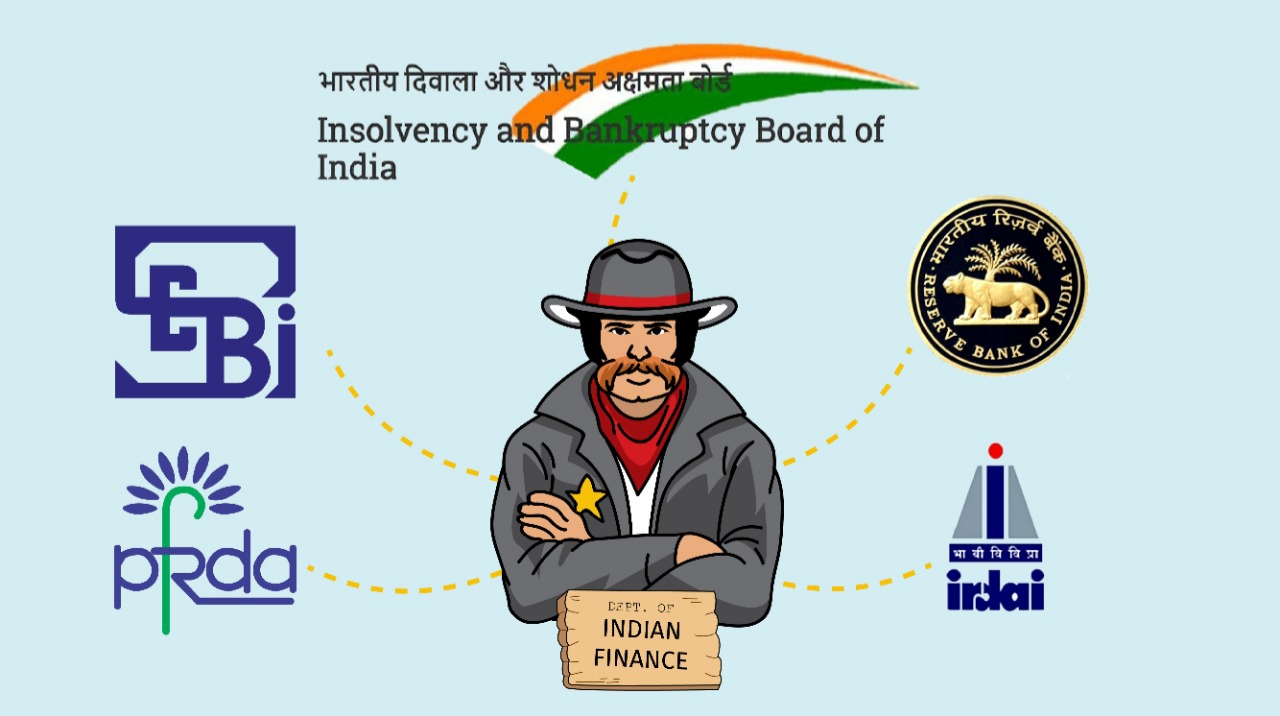

Financial institutions, corporates, banks and investors always seem to find new and exciting ways to lose money. That's why the financial regulators are poised to close the door on their faces every time they try to beat the market. The chief statutory regulators of Indian finance are the RBI, the SEBI, the IRDAI, the PFRDA and the IBBI.

The Reserve Bank of India:

The Reserve Bank of India (RBI) manages the money market and does all the functions that any Central Bank of a country would do. The headquarters of RBI which is, now, in Mumbai used to be in Calcutta.

The first-ever major financial activities in which the RBI was chiefly involved was during the nationalisation of banks in 1969 by the Indira Gandhi-led government. The second time RBI was significantly involved was during the financial restructuring in 1991 done by the Narasimha Rao government when the Indian rupee was devalued. After that, the next big step taken was demonetization in 2016 by the Modi-led government.

Since agriculture is the main occupation of our country, the Indian economy is subject to the whims and uncertainties of the monsoon season and, therefore, food inflation cannot be controlled by the Central Bank, no matter what. Hence, the RBI as the Central Bank cannot exercise its presence, powers and functions over the entirety of the Indian monetary market, as it should.

In order to have firm control over such a vast Indian banking network, the RBI follows the following policies:

- Licensing Requirements - Every commercial bank working in India needs to obtain a license from the RBI. Even to set up a new branch, a license from the RBI needs to be obtained. However, after recent changes, the licensing policy has been relaxed. Now, to open a branch where the population is less than 50,000, a license is no longer required. Foreign banks' entry and expansion are also subject to RBI’s approval. Apart from these, Indian banks also need to get the RBI’s approval to operate overseas.

- Corporate Governance - From time to time, the RBI issues guidelines and other objectives for all commercial banks. Such provisions also contain guidelines for banks' top-level executives about the criteria for directors of banks. The RBI appoints directors of private banks and CEOs of foreign banks operating in India. Their compensation is also decided by them.

- The amalgamation, reconstruction and liquidation of banking companies are supervised by the RBI.

- The RBI also looks into banking transactions to check money laundering and stop terrorism financing. One such measure towards this was the introduction of KYC (Know Your Customer) in the banking system.

- The RBI issues Prudential Norms (Ideal Norms) which are to be followed by all the commercial banks. These norms help banks to strengthen their balance sheets.

- According to RBI’s directives, all banks are ordered to declare their annual financial reports and other documents pertaining to capital adequacy, liquidity and assets quality. These disclosures are important to ensure public confidence in these banks and maintain discipline among these banks.

- Annual On-Site Inspection - The RBI annually goes for onsite inspection of all banks to check their quality of management and other financial prospectus. Based on these inspections, all banks are rated.

- Off-Site Surveillance and Monitoring System (OSMOS) - Apart from onsite inspection, the RBI maintains a hawk-eye view on all banks by the OSMOS. Under this, banks are required to periodically submit a structured report. Based on these reports, the RBI assesses and analyzes the health of banks.

- Credit Control Over Banks - This refers to the various quantitative and qualitative measures undertaken by the RBI to control the money circulation into the market. These measures include:

a.) Bank Rate and Repo Rate - It refers to the rate at which the RBI lends money to commercial banks to meet their short-term needs without any collateral. The interest rate on long-term loans is referred to as the repo rate. During inflation times, when money circulation in the market is high, the RBI increases this rate to curb the excess supply of money. The exact opposite is followed during deflation times.

b.) Open Market Operations - The RBI is authorized by the government to sell and purchase government bonds to and from banks. During inflation times, when money circulation in the market is high, the RBI sells these securities from banks, which leads to a flow of money from these banks to the RBI. The exact opposite is followed during deflation times.

c.) Cash Reserve Ratio - This refers to the ratio of total deposits which banks need to keep with the RBI as a cash reserve. During inflation times, when money circulation in the market is high, the RBI increases this ratio to curb the excess supply of money. The exact opposite is followed during deflation times.

d.) Margin Requirement - It refers to the loan amount and the collateral value offered to the bank. If the RBI has set the margin requirement at 40%, this means that when someone gives collateral of ₹100, they're eligible for a load of only ₹60. During inflation times, when money circulation in the market is high, the RBI increases the margin requirement to curb the excess supply of money. The exact opposite is followed during deflation times.

e.) Moral Suasion - Speeches, notifications and seminars are provided to banks to follow the RBI’s guidelines and opt for selective credit policy according to the prevailing market conditions.

The RBI is, overall, the sole guardian of the Indian banking system. Its overall importance in the success of the Indian economy and banking system is very evident.

The Securities and Exchange Board of India:

The SEBI (Securities and Exchange Board of India) is the statutory regulatory body that is the watchdog over the capital and derivatives market. The main objective of its formation was to incorporate a body that would deal with all matters related to the development and regulation of the security market of India. One of the greatest threats to the markets under the purview of SEBI is insider trading. It was also to look after the protection of investors and advise the government on these matters.

According to the Security and Exchange Board of India Act, their objectives include:

- Protection of investors

- Prevention of malpractice

- Promoting fair and proper functioning

- Establishing a balance

- Establishing a code of conduct

The main duty of SEBI is to protect and safeguard the interests of investors and ensure proper trading. However, the extent to which SEBI has been successful in curbing such crimes has been found to be inadequate.

Insurance Regulatory and Development Authority of India:

The Insurance Regulatory and Development Authority of India (IRDAI) is the statutory, independent and apex body that governs and supervises the insurance industry in India to protect the interests of policyholders. It issues registration certificates to insurance companies, supervises the premium rates and terms of insurance covers and regulates the investment of policyholder's funds by insurance companies. IRDAI also ensures the maintenance of solvency margin (company's ability to pay out claims) by insurance companies.

Moreover, it provides licences to insurance intermediaries such as agents and brokers after specifying the required qualifications and set norms/code of conduct for them. The IRDAI is also in charge of specifying the conditions and manners, according to which the insurance companies and other intermediaries have to make their financial reports. It watches over professional organizations related to the insurance business to promote overall efficiency, development and advancement in the insurance sector.

The Pension Fund Regulatory and Development Authority:

The Pension Fund Regulatory and Development Authority (PFRDA) acts as the regulator of the pension sector in India since 2003.

The Insolvency and Bankruptcy Board of India:

The Insolvency and Bankruptcy Board of India (IBBI) is a recently-established regulatory body given statutory powers under the Insolvency and Bankruptcy Code since 2016. It oversees insolvency proceedings and entities and recovers individuals, companies, limited liability partnerships and partnership firms from insolvency. It was created as the refereeing institution with multiple tasks like resolution, reconstruction and liquidation of falling companies as well as the creation of regulations and control of agencies and professionals involved in the insolvency and bankruptcy business.

Indian finance is safeguarded because of the constant regulation of these statutory bodies. Maintaining the right amount of regulation in a deregulated economy and setup is a challenge and the extent of that regulation is a topic of debate.