There are two reasons as to why a dilution in the price of a stock takes place - Stock Split and Stock Dividend. Although the end result of both of them is nearly the same- shareholders have more shares than before. The intrinsic differences are discussed below.

Dividend and Stock Dividend:

A dividend is the return earned on investing in a particular stock. It is the shareholder’s share of the profit of a company. Now, a dividend is usually paid at the end of the financial year and is credited to the Demat account of the shareholders. It may be cash or in the form of shares.

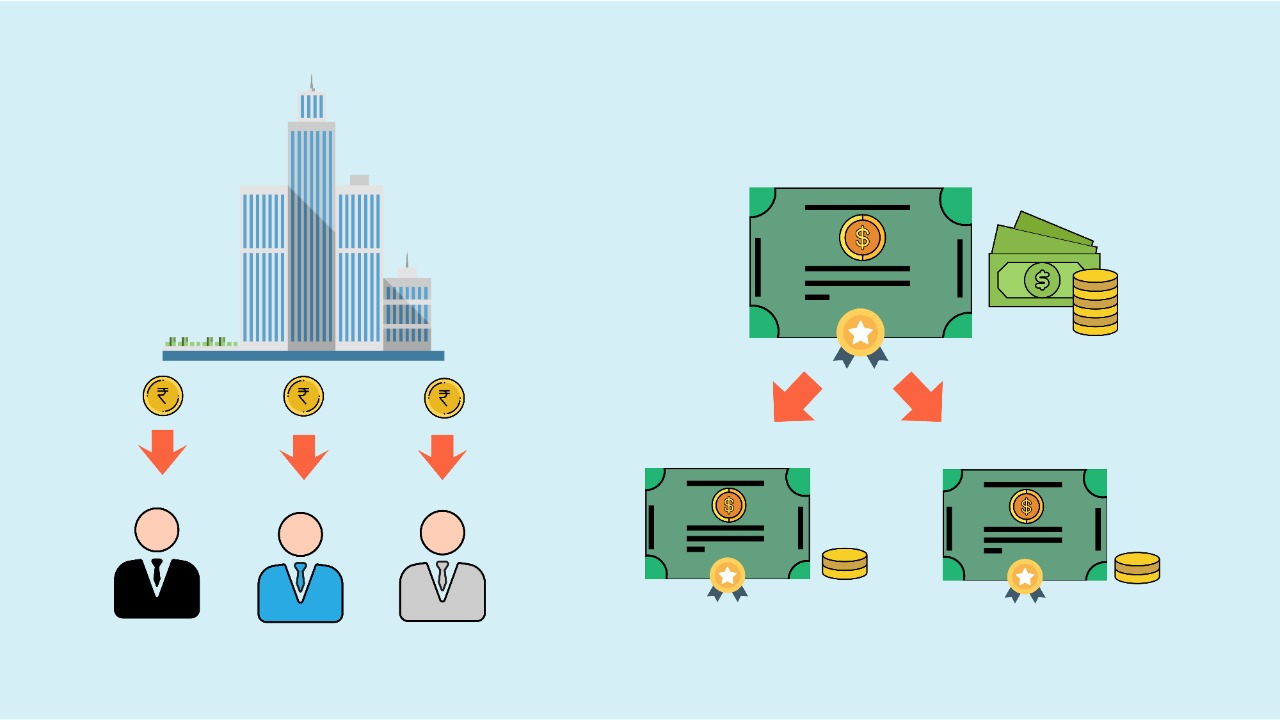

Stock Dividend as the word suggests refers to the dividend paid as additional shares of the company. It is also called the Scrip dividend. Just like the dividend is paid based on the number of shares owned, the stock dividend is distributed as a fraction for the number of shares.

The company declares dividend at the end of the year and distributes it based on shares owned, similarly when the company declares stock dividends, it does so in the percent units. Suppose a company declares a 20% stock dividend, it means that the company will issue 0.2 shares per each share owned in the company. This means that a person owning 10 shares in the company will get 2 additional shares as a stock dividend. Now the dividend for a share is paid out of its profits which later on become retained earnings for the firm. The cash dividend thus will reduce the company’s cash fund.

Therefore, stock dividends are paid by those firms which do not want to reduce their cash balance and retain it for further production. The stock dividend just like the regular cash dividend is tax-free. However, in some cases, there may be a clause prohibiting the sale of additional stocks for a few days. Stock dividends require journal entry which moves the value of additional shares from retained earnings to the paid-up capital.

The size of the stock dividend is said to be small if it is less than 25% of the existing shares while it is large if it is more than 50% of the existing shares. However, the highlight is that the stock dividend will not increase the percentage of shares owned by an individual.

Let’s see how this works - Now if a person has 100 shares in a company, which has 1000 shares, so the stake here is 10% and the company declares a 5% stock dividend so each owner gets 5 shares extra thereby making the tally 105. But now it is out of 1050 shares so individuals stake remains at 10%. The dilution effect of the stock dividend is due to the fact that it increases the number of available shares in the company so it reduces the value of existing shares, thereby causing dilution.

Stock Split:

As the word suggests stock split is where an existing share is broken down into n number of small shares with proportionate prices. The aim is to boost the liquidity of the shares.

So suppose a company has each share priced at 50$, and it decides to split the share in the ratio 1: 5, this share will be broken into 5 shares costing 10$ each. The immediate result of the stock split is reduced the face value of the share of the company and reduced price, in the above case from 50$ to 10$.

This is done to make the price favorable to the majority of investors as investors are often proven to go for the number of shares at affordable prices. Prior approval is sought for a stock split, the shares are credited to the Demat account of the holder.

Now let’s see how this works- suppose you have 10 shares of 50$ each, now the price has been high due to demand for the share since the price is high, the volatile change is less so at most it can see an addition on 5 in price, that makes its 550$ Investment. Now similarly if you have 50 shares of 10 $ each, they are affordable to a large group of investors so bid price will go up, since the asking price is 10, the price change can be as high as 6 per share So that makes it 16$ per share for 50 shares, and so you have 800$ investment. Hence the main purpose of a stock split is to increase competition among shareholders and buyers by making it affordable.

The point here is that a stock split brings no difference to the value of holding of an investor. This is because if an investor owns 10 shares of 50$ each, now he will own 50 shares of 10$ each due to the stock split, his total investment will remain unchanged. The number of shares will increase but the value per share will decrease. Thus there is also no change in the company’s’ share capital as well. Therefore market capitalization remains unchanged as well.

Though very similar in their results, the approach to a stock dividend and stock split is different. While the stock dividend is aimed to incentivize the production segment by saving cash reserves, the stock split is done to facilitate more trading at a lower price by breaking down the chunk of share into smaller ones.

Here are some of the key takeaways from this comparison between stock splits and stock dividends:

- Stock dividend is the dividend paid in the form of stocks.

- Stock split is breaking down existing stock into small ones.

- Stock dividends portray the dilution effect by increasing the number of shares in the market while stock splits dilute prices by reducing face value per share.

- Stock split decision is taken by the board of directors.